The modern enterprise faces a paradox: unprecedented access to data and insight, yet mounting complexity in decision-making. The solution emerging across boardrooms and C-suites is a Generative AI Strategy for business—a deliberate, structured integration of generative artificial intelligence into core operations. When crafted with foresight, this strategy not only accelerates innovation but also fortifies compliance, sustainability, and competitive positioning.

The Strategic Imperative: Why Generative AI Demands Board-Level Attention

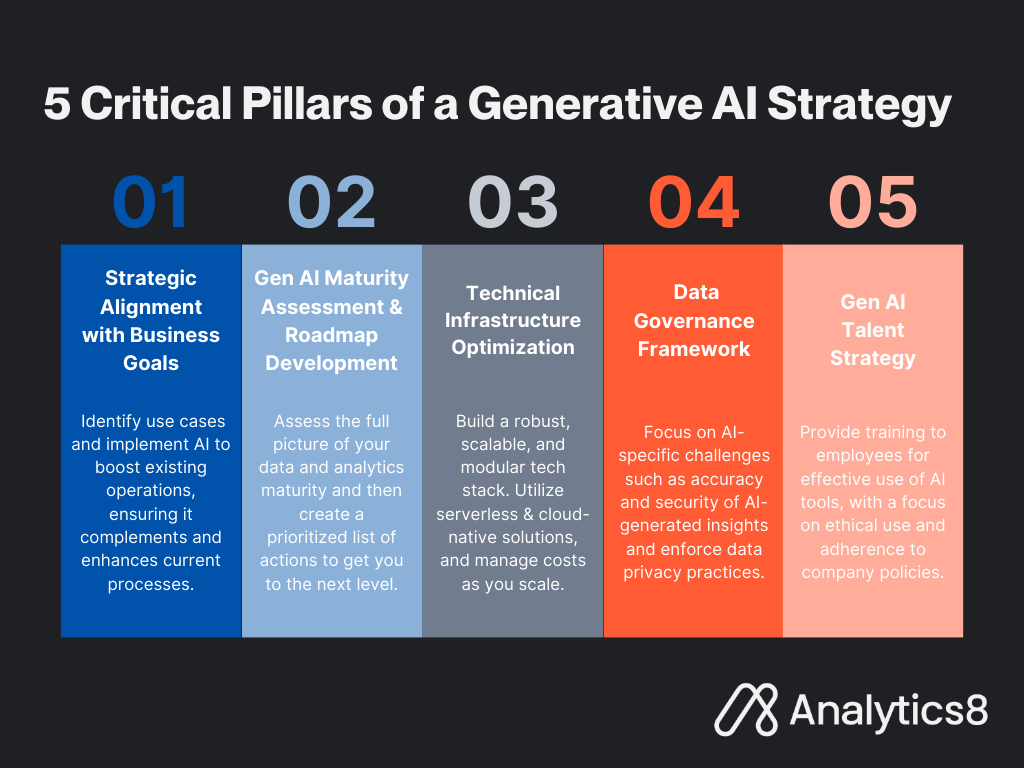

A Generative AI Strategy is more than deploying advanced algorithms. A comprehensive framework that integrates AI into governance structures, operational processes, and external business strategies. Organizations that elevate AI to a strategic cornerstone—where compliance and growth align—are better prepared to maintain a competitive edge while adapting to evolving rules.

Key pillars of AI-driven corporate governance include:

- Data Sovereignty Compliance: Ensuring that AI systems handle personal, financial, and proprietary data within jurisdictional regulations.

- Intellectual Property Clarity: Defining rights over AI-generated content to safeguard against disputes.

- Ethical Deployment Standards: Embedding accountability mechanisms to prevent bias, misinformation, or discriminatory outputs.

The enterprise that views AI as an extension of its governance architecture gains both legal defensibility and operational resilience.

AI in Industry: Precision Transformation Across Sectors

Generative AI is not a one-size-fits-all innovation—it manifests differently in manufacturing, retail, energy, and professional services.

Manufacturing and Green Technology & Renewables

In advanced manufacturing, AI-driven design accelerates prototyping and reduces resource wastage. Coupled with Green Technology & Renewables, AI optimizes energy consumption patterns, forecasts equipment failures, and facilitates predictive maintenance. This synergy enables companies to align with Circular … Read More